tax sheltered annuity taxation

Taxes are due once money is withdrawn from the annuity. Assets that have a designated beneficiary listed on the account are allowed to transfer ownership outside of probate.

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

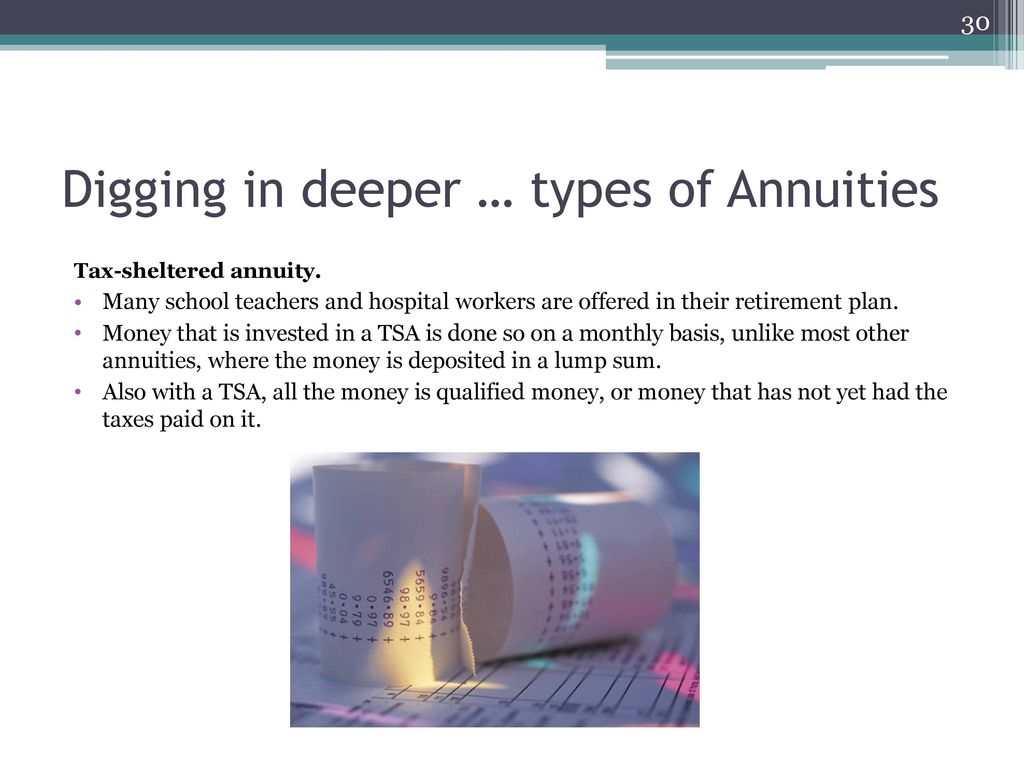

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. The maximum amount of elective deferrals an employee can contribute annually to a 403 b is generally the. Can a tax-sheltered annuity be rolled into an IRA.

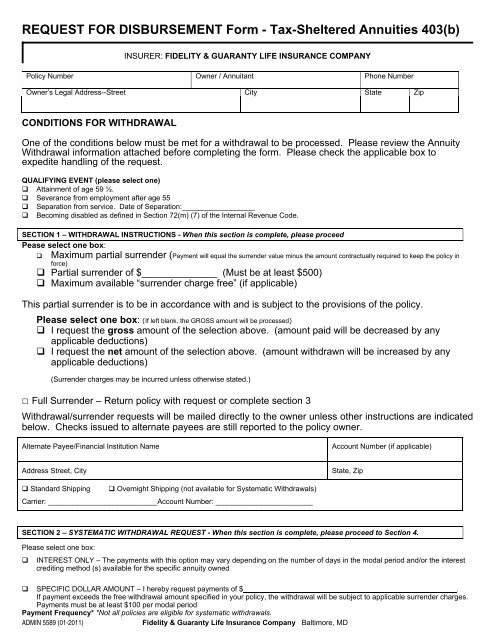

A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts. Insurance Annuity Death Claim Statement 140838 Outgoing Tax Qualified Annuity TransferRollover 30482 Outgoing Non-Qualified 1035 Exchange 30481 Account. Of course this is assuming you have a pre-tax annuity.

The employee will not pay any taxes on their. Generally the best way for surviving spouses to minimize tax liability on an. The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income.

Complete the following applicable lines. Such assets referred to as non-probate assets include. The following banks and credit unions have the highest CD rates for 3 months.

Employees save for retirement. Annuity Taxes for Surviving Spouses. I elect not to have income tax withheld from my pension or annuity.

After that age taking your withdrawal as a. The terms tax-sheltered annuity and 403b are often used interchangeably. Specifically whether a tax-sheltered annuity can be.

Description of Tax-sheltered Annuity Resources See Also 403B Plan Under Employee Benefit Plan. Best 3-Month CD Rates. What is the maximum contribution to a tax-sheltered annuity.

Of Your Pension or Annuity Contract City State and ZIP Code. In general if you withdraw money from your annuity before you turn 59 ½ you may owe a 10 penalty on the taxable portion of the withdrawal.

Money Helps March 1980 Money Archives

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

Learn About Retirement Income And Annuity Tax H R Block

Request For Disbursement Form Tax Sheltered Annuities

Qualified Vs Non Qualified Annuities Taxation And Distribution

How To Avoid Paying Taxes On Annuities Valuewalk

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Online Annuity Suitability Ppt Download

Annuity Distributions The Taxes You Need To Know Borshoff Consulting

The Tax Sheltered Annuity Tsa 403b Calculator

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

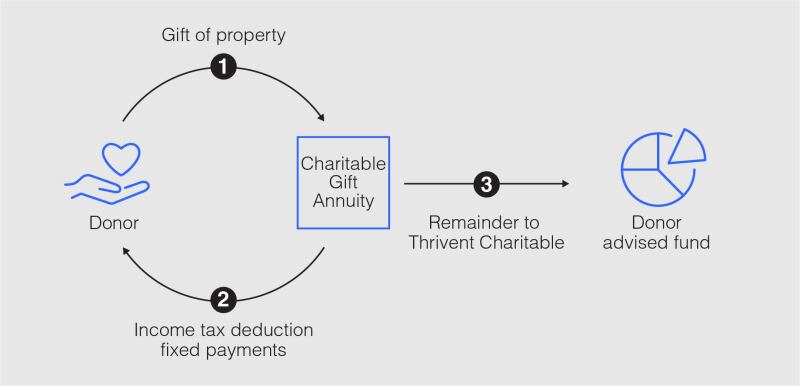

What Is A Charitable Gift Annuity Thrivent

Withdrawing Money From An Annuity How To Avoid Penalties

How To Figure The Taxable Portion Of Annuities 2022

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Annuity Taxation How Various Annuities Are Taxed

Online Annuity Suitability Ppt Download