will child tax credit continue in 2022

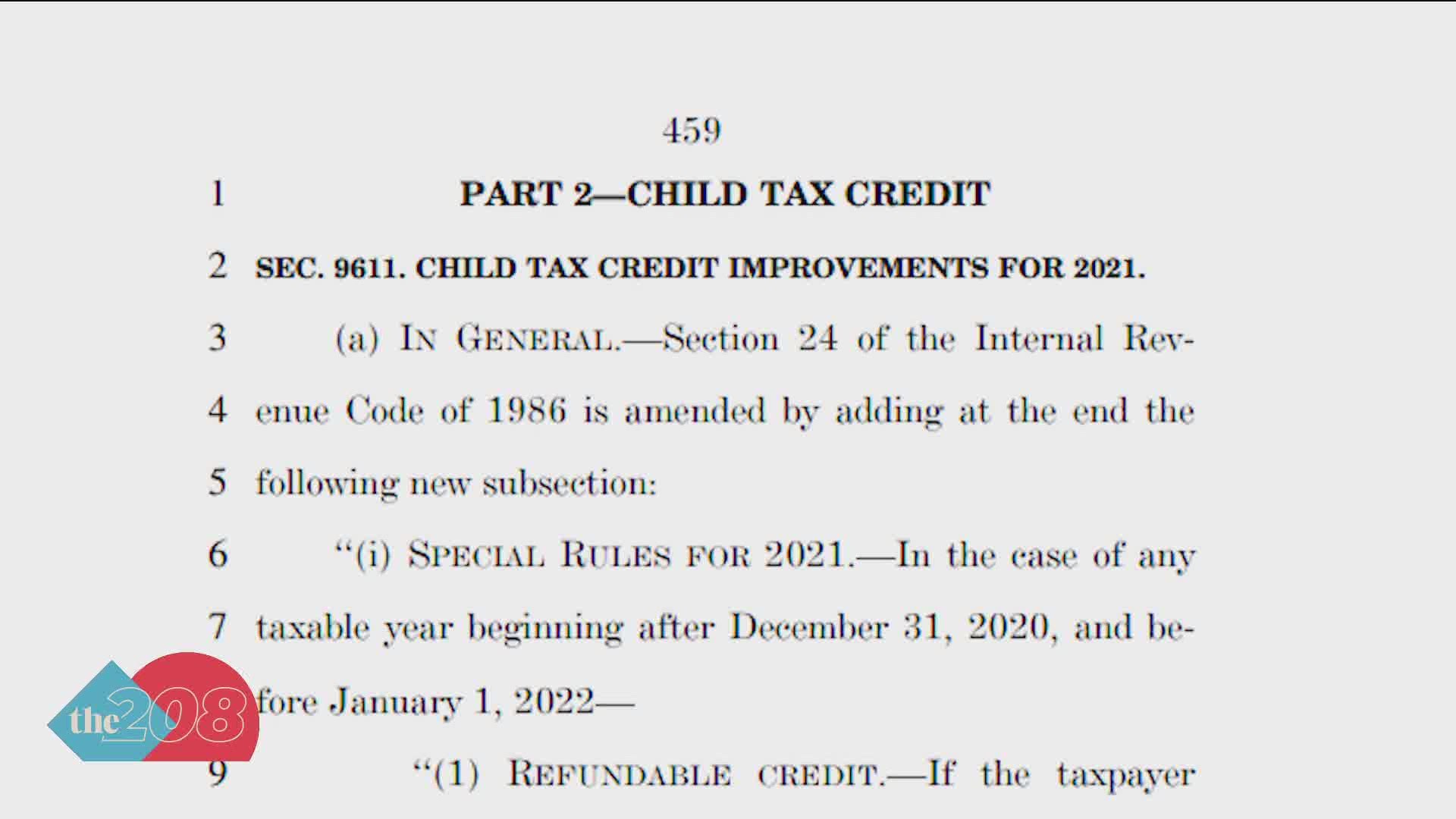

Filers could get up to 35 credit on 3000 of child care expenses for one child under age 13 or an incapacitated spouse or parent. The new child tax credit was included in Marchs American Rescue Plan Act and mandated that each eligible.

Get The Child Tax Credit Hawaiʻi Children S Action Network

In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you.

. 9 hours agoThe Child Tax Credit in 2022 is a powerful tax tool that can help you save on your taxes. It is a tax credit that you claim. Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per.

Up to 3600 per child or up to 1800 per child if you. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. How much money you could be getting from child tax credit and stimulus payments.

This means that the credit will revert to the previous amounts. Angela Reyes Melo 56 waits outside her car before driving to pick up supplies at a food bank. In fact he wants to try to make those payments last for years to come all the way through 2025.

Its-a-write-off 3 min. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400.

Will there be child tax credits in 2022. This year the Child Tax Credit will revert back to the program offered by the IRS before the American Rescue Plan expanded it in 2021. President Biden wants to continue the child tax credit payments in 2022.

4 hours agoPoverty drops in California but only because of child tax credit COVID relief funds. Theres a slim chance. Currently the child tax credit is set to expire in 2022 Credit.

In 2022 the tax credit could be refundable up to 1500 a rise from. There is a child tax credit each year. Will child tax credit continue in 2022.

October 6 2022 809 AM CBS Los Angeles. Notify the IRS of an address or name change to make sure the IRS can process your tax return send your refund or contact you if needed. Support the bill Senator Joe Manchin D-WVa is opposed to continuing the child tax credit in 2022.

The Child Tax Credit 2022 is now worth up to 2000 per qualifying child and can be. 1 day agoThe congresswoman from Connecticuts Third Congressional District DeLauro stated on Thursday that when Congress reconvenes she will launch a fresh campaign to reinstate the. So yes its up to 2000 per eligible child in 2022.

Enhanced child tax credit. This year the Child Tax Credit will revert back to the program offered by the IRS before the American Rescue Plan expanded it in 2021. No changes to that are proposed yet for 2023.

11 hours agoAn updated proposal from Senators Mitt Romney R-UT Richard Burr R-NC and Steve Daines R-MT would improve the Child Tax Credit benefit in several ways. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Will we get a child tax credit in 2022.

5 hours agoThe Child Protection Center in Jackson County says its personnel and resources would be severely impacted if the countys sales tax isnt renewed during Tuesdays election. 1 day ago2022 rules youll use for filing. Although most Democrats in Washington DC.

Keeping Child Tax Credit Fully Refundable Is Critical To Low Income Families Tax Policy Center

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit Will Monthly Payments Continue Next Year Al Com

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Is The Child Tax Credit Going Away In 2022 Yes And No

Irs Sends Out Final Child Tax Credit Payments 11alive Com

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

What Is The Child Tax Credit And How Much Of It Is Refundable

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Tax Credit Extension 2022 When Is The Deadline And Will There Be Payments Next Year The Us Sun

Child Tax Credit Including How The 2021 Relief Bill Changed It Wsj

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Child Tax Credit Research Analysis Learn More About The Ctc

Four Reasons The Expanded Child Tax Credit Should Be Permanent Rwjf

Stimulus Update Final Child Tax Credit Payment Of The Year Arrives In 1 Week